30.06.2025

Whisky Price Development Across Five Years: Factors and Forecasts

Whisky Price Development Across Five Years: Factors and Forecasts

Whisky prices have experienced dramatic shifts over the past five years.

-

Japanese whisky production dropped by nearly 80% since the mid-1980s, creating scarcity and driving up demand.

-

Auction records show standout bottles like Karuizawa 1960 The Archer fetching $140,140 and Yamazaki 55-year-old reaching $256,162.

-

In 2023, rare whisky prices rose by 13%, even as the fine wine market declined.

-

New regulations in 2024 now require bottles labeled "Japanese" to meet strict standards, increasing authenticity and long-term value.

These movements highlight the importance of understanding market forces for collectors, investors, and enthusiasts.

Key Takeaways

-

Whisky prices have changed a lot in the past five years due to supply shortages, especially in Japanese whisky, and growing demand for rare bottles.

-

Economic factors like taxes, tariffs, and inflation affect whisky costs and can cause price ups and downs in the market.

-

Market corrections have lowered prices and auction volumes, creating good chances for buyers to find quality bottles at better prices.

-

Different whisky segments serve various buyers—from everyday drinkers to collectors and investors—so knowing your market helps make smart choices.

-

The whisky market is expected to grow steadily, but buyers should watch risks like regulations, supply issues, and counterfeiting to stay ahead.

Whisky Price Timeline

Growth and Hype

Between 2012 and 2022, the whisky market experienced a period of rapid growth and excitement. High taxation rates on spirits in Canada played a significant role in shaping pricing dynamics. For example, British Columbia imposed combined sales and provincial taxes that increased retail costs, while Ontario maintained zero-rated HST on alcohol, keeping shelf prices stable. These tax policies pressured distilleries to increase production volumes to maintain profitability, which influenced both availability and pricing.

The Canadian spirits industry supported thousands of farming jobs and contributed billions to the national economy, highlighting its importance. Award-winning releases, such as Pike Creek 22, which earned the title of World's Best Blended Limited Release in 2022, fueled consumer interest and drove up demand for premium bottles. Globally, auction records for rare bottles, including Japanese and Scotch whiskies, set new benchmarks and attracted collectors and investors. The post-COVID period saw asset inflation, with whisky prices reaching dramatic highs in 2021 and 2022.

Decline and Volatility

After the surge in prices, the whisky market entered a phase of decline and volatility.

-

Auction sales volumes and values dropped sharply after peaking in 2021-2022, especially for high-end lots.

-

Export values fell by 9.5% from 2022, though they remained above pre-pandemic levels, indicating that demand persisted despite short-term corrections.

-

Market corrections began in 2023, with both cask and bottled whisky prices stabilizing or declining.

-

Macroeconomic factors, such as inflation, rising interest rates, and geopolitical uncertainty, reduced buyer enthusiasm and speculative activity.

-

Distilleries and auction houses adjusted their strategies, focusing more on collectors and less on speculative investors.

In 2023, Scotch whisky exports totaled £5.6 billion, with 1.35 billion bottles shipped worldwide. Although export values dipped, they still exceeded pre-pandemic figures by 14%. The UK economy faced challenges, including higher living costs and cautious consumer spending, which contributed to a drop in sales and a shift in business strategies.

Recent Stabilization

By mid-2024, the whisky market began to show signs of stabilization.

-

Secondary market trading volumes and values continued to decline through the third quarter of 2024, reaching low levels even after accounting for seasonal effects.

-

Some segments, such as Scotch and Irish whiskies, demonstrated price stability or slight gains from mid-2024 onward.

-

Brands like Macallan and Springbank, which had seen significant price drops over the previous two years, moved into sideways price trends, signaling early stabilization.

-

The market environment became more measured, with a focus on long-term collectors rather than short-term speculators.

Note: The timeline of whisky price changes reflects a cycle of hype, correction, and stabilization. Collectors and investors should monitor these trends closely to identify new opportunities and manage risks effectively.

Market Factors

Supply and Demand

Supply and demand play a central role in shaping whisky prices. Producers often face capacity constraints, especially for rare or aged expressions. When supply cannot keep up with demand, prices rise. Empirical data from OECD countries between 2003 and 2016 shows that excise taxes on alcoholic beverages, including Scotch whisky, are often passed through to retail prices.

For higher-priced products, manufacturers sometimes increase prices even more than the tax itself. This strategy helps them maintain profits when demand is strong. In some cases, producers deliberately underprice limited releases to create a sense of scarcity. This approach can increase long-term demand and support higher prices in the future. The market structure, price elasticity, and consumer perception of rarity all influence how supply and demand interact in the whisky industry.

Economic Pressures

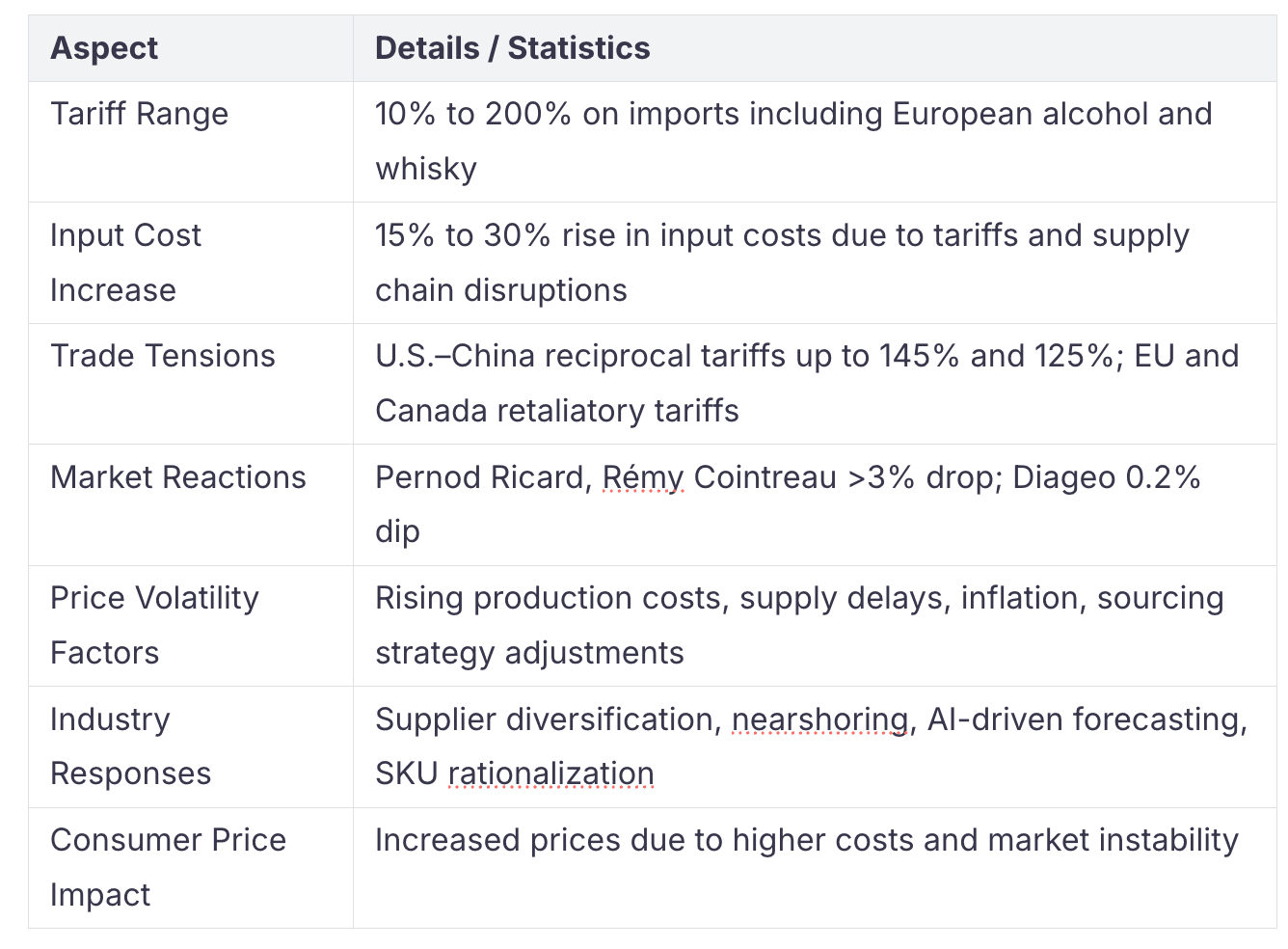

Economic pressures, such as inflation and trade tensions, directly affect whisky pricing and market volatility. Rising energy costs and supply chain disruptions increase production expenses. When tariffs rise, input costs can jump by 15% to 30%. These changes force producers to adjust their pricing strategies. The imposition of a 200% tariff on European alcohol imports led to immediate drops in major alcohol company stocks and broader market indices. The following table summarizes key economic factors impacting whisky prices:

These factors combine to create a challenging environment for both producers and consumers.

Regulation and Trade

Regulation and trade policies have a measurable impact on whisky pricing. Recent trends include:

-

Sustainability mandates in major markets require producers to track water use, carbon emissions, and packaging waste. These rules push companies to adopt greener methods, which can increase costs.

-

The 2025 United States tariff adjustments on imported Scotch whisky have raised landed costs. Producers and importers now focus more on premium products to offset these expenses.

-

Trade policies have led to higher retail prices and encouraged strategies like bonded warehousing and direct-to-consumer sales to reduce tariff impacts.

-

Evolving excise structures and ongoing trade negotiations require agile sourcing, logistics, and distribution.

-

Companies shift their portfolios toward premium and ultra-premium expressions to maintain higher price points.

-

Distribution channels adapt by consolidating orders and innovating on-trade offerings to sustain sales despite tariff pressures.

These regulatory and trade changes force the industry to remain flexible and innovative.

Investor Behavior

Investor behavior also shapes the whisky market. Many collectors and investors seek financial returns, not just enjoyment. A study of over 83,000 sales records in the Scotch whisky second-hand market found that reputation premiums linked to geographical origin persist even after accounting for distillery reputation and bottle features. This collective reputation effect attracts both experienced and inexperienced investors. Some buyers speculate on price increases rather than focusing on quality. The presence of speculative investors can drive prices higher during boom periods but may also contribute to volatility when market sentiment shifts. Collectors with diverse motives, including profitability, add further complexity to the market.

Note: Understanding these market factors helps collectors, investors, and enthusiasts make informed decisions. Monitoring supply and demand, economic pressures, regulatory changes, and investor trends is essential for navigating the evolving whisky landscape.

Whisky Market Segments

Collectibles vs. Everyday

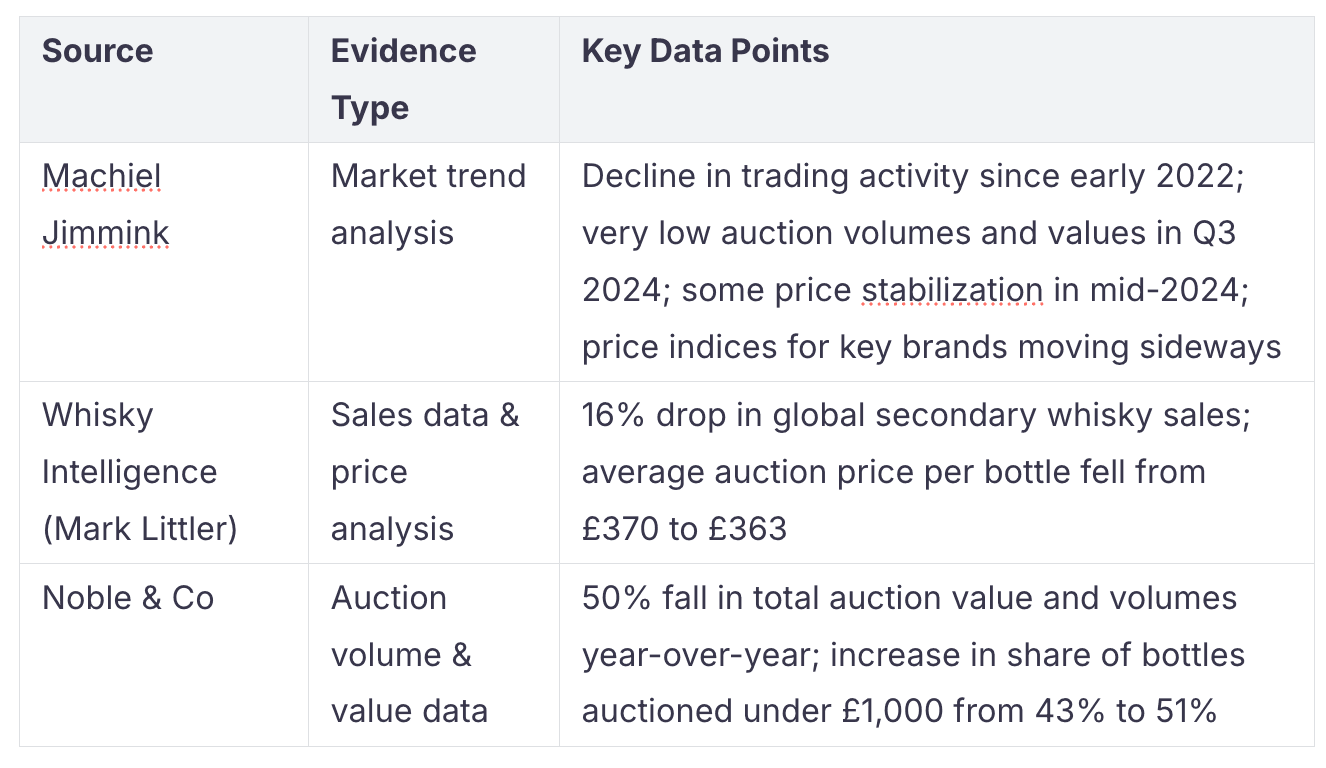

Collectors often seek rare bottles, limited editions, or releases from closed distilleries. These bottles can command high prices at auction, especially when scarcity and brand reputation align. Everyday consumers, on the other hand, focus on affordability and accessibility. They purchase bottles for regular enjoyment rather than investment. The market has seen a recent downturn in rare and ultra-premium bottles, with auction sales volumes dropping by 16%. Average bottle prices in this segment fell from £370 to £363. This shift suggests that while collectibles remain desirable, everyday options continue to dominate sales.

Casks and Investments

Cask investment has gained popularity as buyers look for alternative assets. Investors purchase whole casks, often holding them for several years before bottling or reselling. This approach offers potential for higher returns but also carries risks, such as storage costs and market volatility. The decline in bottles priced between £1,000 and £10,000—down 34% in volume and 32% in total sales value—shows that even cask investments face challenges during market corrections. Investors must weigh the potential rewards against these risks.

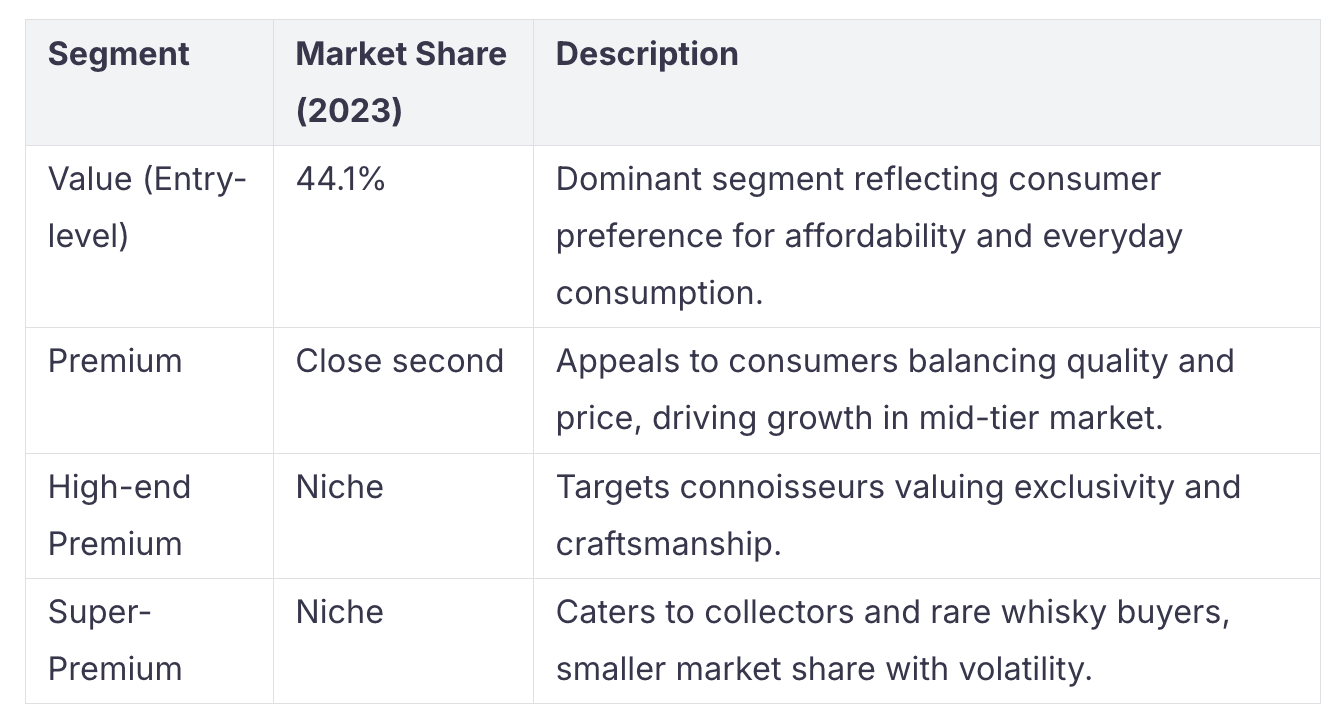

Premium vs. Entry-Level

The whisky market divides into several segments based on price and quality. The following table summarizes the current landscape:

Recent years have seen initial growth in premium segments, driven by niche consumer interest. Forecasts for 2025-2035 predict mass premiumization, with the global market expected to reach USD 118.5 billion and a CAGR of 11.3%.

Regional Trends

Regional preferences shape the whisky market. North America and Europe continue to favor premium and super-premium expressions, while Asia shows growing interest in both collectibles and everyday bottles. Regulatory changes and shifting consumer tastes influence these trends. Producers adapt by offering region-specific releases and marketing strategies.

Note: Understanding these segments helps buyers and investors navigate a complex and evolving market.

Market Corrections

Secondary Market Drop

Recent data shows a significant drop in the secondary market. Auction volumes and values have fallen sharply since the peak in early 2022. The following table summarizes key findings from multiple sources:

These figures highlight a market correction phase, with fewer high-value transactions and a shift toward more affordable bottles.

Impact on Buyers

Market corrections influence buyers in several ways. Many consumers show limited price awareness and purchase spirits infrequently. Strong brand loyalty and retailer dependence on major brands help stabilize product availability, even during economic downturns. Income levels and disposable income predict the likelihood of purchasing premium bottles. Price sensitivity increases as economic conditions change, leading buyers to adjust their spending habits.

-

Income and disposable income levels predict premium purchase behavior.

-

Price sensitivity and spending tiers shift during corrections.

-

Predictive analytics help forecast demand changes.

-

Purchase drivers and channel preferences evolve with economic cycles.

These factors combine to shape how buyers respond to market corrections, often resulting in more cautious purchasing and a focus on value.

New Opportunities

Market corrections create new opportunities for both collectors and investors. Lower prices for rare bottles and casks allow entry at more accessible levels. Buyers can diversify their collections or portfolios with less risk. Retailers and producers may introduce innovative products or limited releases to attract attention. Predictive analytics and consumer insights help identify emerging trends and untapped segments.

Tip: Buyers who stay informed and flexible can benefit from market corrections by acquiring quality bottles at reduced prices and positioning themselves for future growth.

Forecasts

Growth Outlook

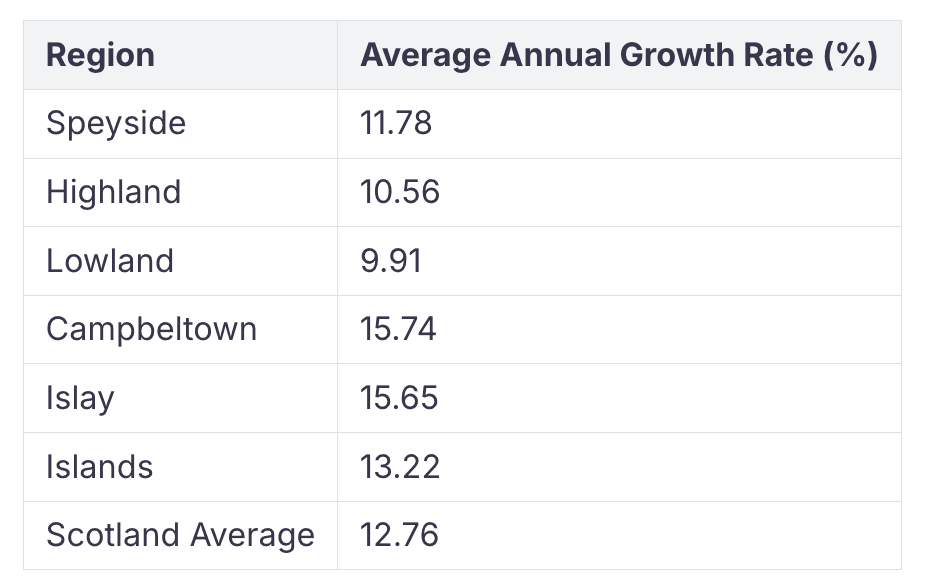

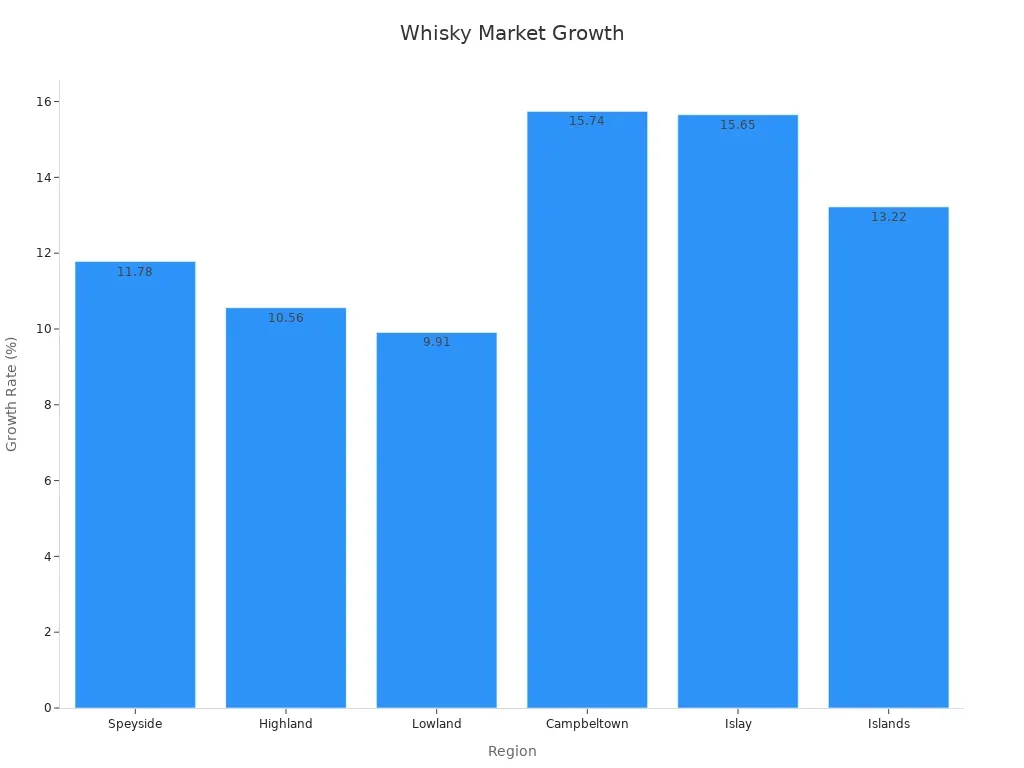

Industry analysts project a strong outlook for the global spirits market. The sector expects steady expansion, with the market size rising from $68.37 billion in 2024 to $85.62 billion by 2029. This growth reflects a compound annual growth rate (CAGR) of 4.6% to 4.8%. The U.S. market alone holds a value of $20 billion in 2024, with a revenue growth rate of 4.85%. Regional performance varies, with Scottish distilleries showing especially robust numbers. The table below highlights average annual growth rates by region:

These figures suggest strong investment and expansion potential, especially in regions like Campbeltown and Islay.

Risks Ahead

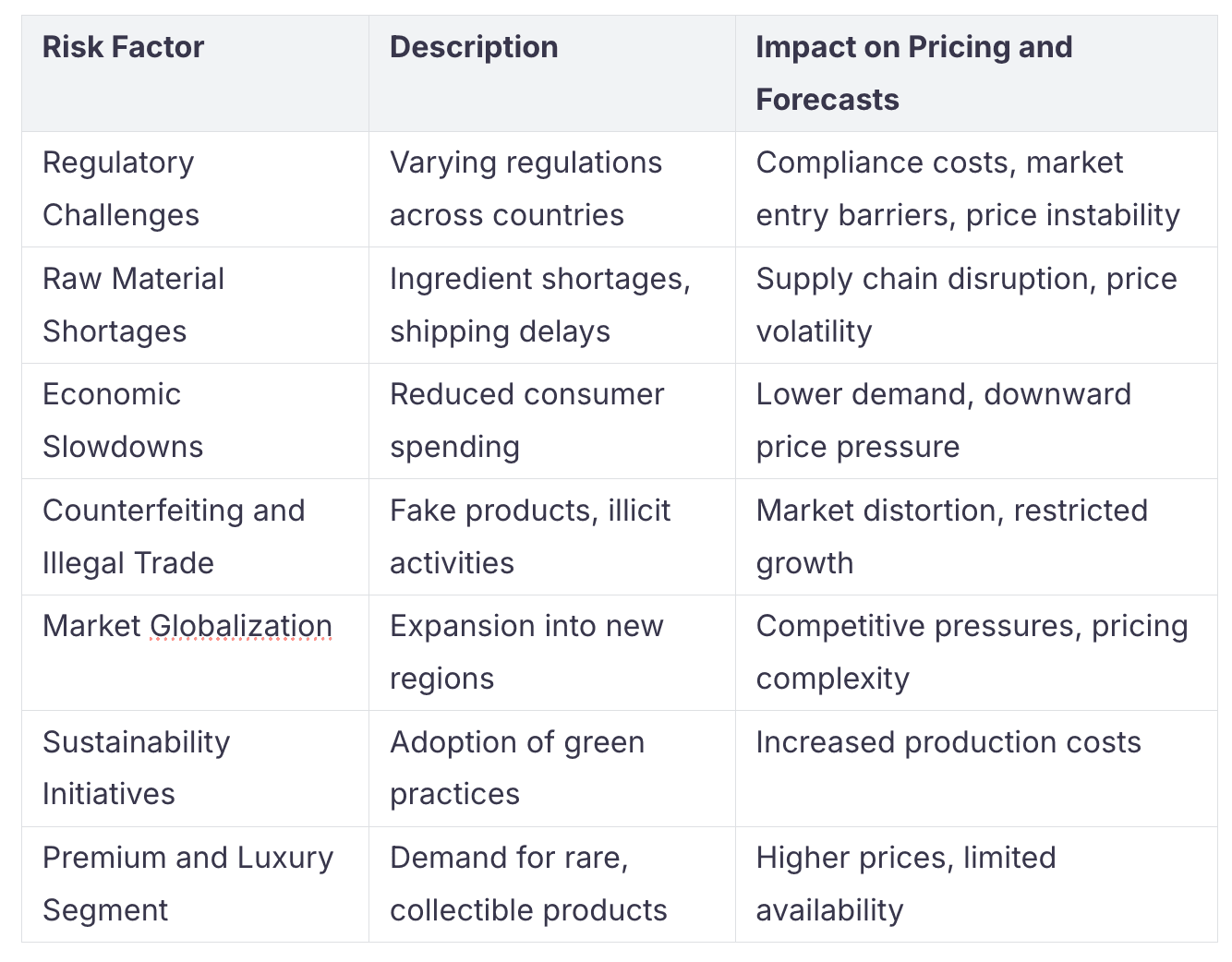

Several risk factors could impact future price trends and market stability. Key risks include:

-

Counterfeiting and illegal trade, which distort pricing and limit legitimate growth.

-

Regulatory challenges, such as varying production and labeling rules, that increase compliance costs.

-

Raw material shortages and shipping delays, which can disrupt supply chains and cause price volatility.

-

Economic slowdowns, leading to reduced consumer spending and downward price pressure.

-

Sustainability initiatives, which may raise production costs.

-

Market globalization, introducing new competition and regulatory complexity.

-

The premium and luxury segment, where limited availability and collector demand can drive prices higher.

What to Watch

Market participants should monitor several indicators to validate and adjust forecasts:

-

Demand trends and consumer preferences

-

Inventory levels and stock turnover

-

Production efficiency

-

Brand awareness and reputation

-

Financial forecasts, including revenue and profit margins

-

Scenario planning for regulatory and economic changes

-

Real-time analytics, such as sales data and social sentiment

-

Regional consumption patterns and demographic shifts

Tip: Tracking these indicators helps businesses and investors align strategies with market realities and respond quickly to emerging risks or opportunities.

The whisky market continues to evolve, shaped by both short-term volatility and long-term growth. Key trends include:

-

Market value reached $67.58 billion in 2024, with a projected CAGR of 5.18%.

-

American whiskey exports hit $1.7 billion in 2022, showing strong demand.

-

Premium and high-end segments expand as consumers seek quality and authenticity.

-

North America and Asia-Pacific drive regional growth.

Collectors, investors, and enthusiasts should monitor these shifts, use reliable data, and stay adaptable to succeed in this dynamic environment.

FAQ

What drives whisky price changes?

Whisky prices respond to supply, demand, economic shifts, and regulations. Producers adjust prices based on costs, taxes, and consumer interest. Collectors and investors influence rare bottle values. Market corrections and global events also play a role.

Is whisky a good investment in 2024?

Analysts see long-term growth potential, especially for rare bottles and casks. However, recent market corrections show risks. Investors should research, diversify, and monitor trends before committing funds.

How do tariffs affect whisky prices?

Tariffs increase import costs. Producers often pass these costs to buyers, raising retail prices. Trade tensions can also disrupt supply chains and limit product availability.

Are rare whiskies always more valuable?

Not always. Rarity can boost value, but brand reputation, age, and market demand matter. Some rare bottles lose value during market corrections or if trends shift.

What risks should whisky buyers consider?

Buyers face risks like counterfeiting, regulatory changes, and economic downturns. Price volatility and supply chain issues can also impact value. Staying informed helps manage these risks.

About the author

Majda Hübner

My journey with whisky truly began when I joined Spiritory in 2024. What started as a job quickly grew into a deep appreciation for the stories behind each bottle. From elegant Highland single malts to bold American rye, every expression has its own unique charm. Through the blog, I share discoveries, insights, and favorites hoping to inspire both newcomers and fellow enthusiasts alike. If you love whisky or are just starting to explore it, welcome - you’re in good blog.