03.05.2025

How to Build a Profitable Whisky Investment Portfolio

How to Build a Profitable Whisky Investment Portfolio

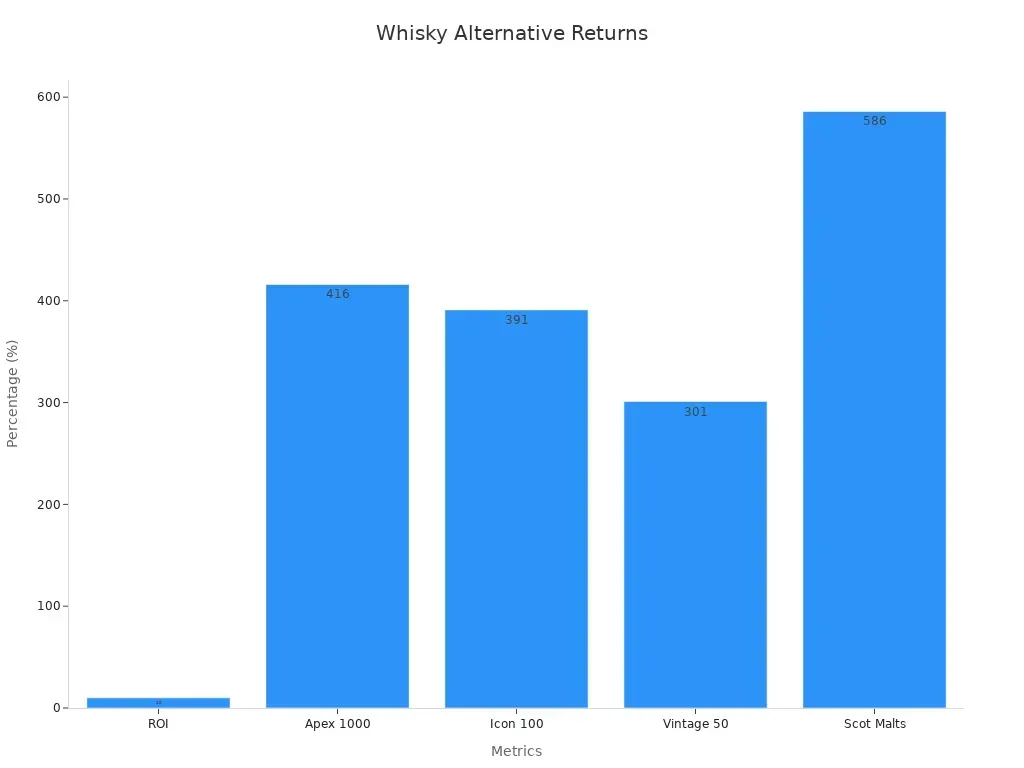

Whisky investing offers more than just a sip of luxury-it’s a smart way to grow your wealth. Rare whisky values have skyrocketed at it's peak by 586% over 10 years in 2021, outperforming other alternative investment like cars, handbags, and even fine wine. Cask whisky investments have yielded a 62% return since 2018, beating the 58% return of gold. The global whisky market is set to hit $85.62 billion by 2029, proving its strength as a growing asset class. Whether you’re drawn to bottles, casks, or limited editions, whisky can be your ticket to a profitable portfolio. Here is your whisky investment guide who shade some light into the darkness.

Key Takeaways

-

Investing in whisky can grow your money a lot. Rare whiskies have gone up in value by 280% in 10 years.

-

Buying different whisky brands, types, and from various places reduces risks and can help you earn more.

-

Having clear goals for your whisky investments keeps you on track and focused on making money.

-

Storing your whisky properly and keeping records is important to keep it valuable and real.

-

Selling at the best time and using different ways to sell can help you make the most profit.

Why Whisky Investing is Profitable

Market Trends and Historical Performance

Whisky as an investment has done better than many usual assets. Rare whisky prices have grown by 280%, showing big gains. Unlike stocks or houses, the most sought after whiskies stay steady during tough economies, even considering a recent correction in the market.

Here’s a simple look at whisky’s success:

Benefits of Whisky as an Alternative Asset

Whisky investment has special perks as a different kind of investment. Its rarity, natural scarecity and small supply give it real value. Famous bottles like the Macallan 1926 sold for over $1 million and others gained value in the 1000%+ over the years.

Whisky investment also helps spread out risks. Unlike stocks, its price doesn’t depend on inflation or market changes. Studies show rare whiskies give about 10% yearly returns. This makes them a safe pick for balancing risk and reward.

Factors Driving Global Demand

The world’s love for whisky keeps growing because of these reasons:

-

Limited editions are rare, making them more valuable.

-

Whisky’s prestige and culture make it highly wanted.

-

New markets like China and India are buying more.

-

Young adults in the West now enjoy aged premium spirits.

These trends show whisky as an investment isn’t just fancy-it’s smart money planning.

Understanding Whisky Investment Basics

Types of Whisky Investments (Bottles, Casks, Limited Editions)

Whisky investing gives you different ways to start. Each option has its own risks and rewards. Here’s a simple guide:

Type of Investment

Bottles

-

Buy single bottles and sell them later. Rare ones grow in value.

-

Values rise steadily over time.

Casks

-

Buy whisky casks and let them age for profit.

-

Aging boosts returns over time.

Stocks

-

Invest in shares of whisky companies or distilleries.

-

Expected growth to £86.1 billion by 2025.

Funds

-

Put money into expert-managed whisky funds.

-

Becoming more popular as the market grows.

Tokinisation

-

Tokenplatforms who offer access to alternative assets

-

Shows overall market trends.

If you’re new, bottles are the easiest way to begin. For bigger, long-term profits, casks are a smart pick. Whisky cask investment is in particular interesting for people who know what they buying into. However, invest in whisky when you are also willing to learn about it.

Key Factors Influencing Whisky Value

Not all whisky is worth the same. Some things decide how much a bottle or cask will be worth later.

Factor:

- Supply and Demand

Rare whiskies with high demand become more valuable.

- Cost of Manufacturing

Longer aging and higher costs make whisky more expensive.

- Marketing Efforts

Good branding and ads can make certain whiskies more wanted.

- Impact of Cask Investment

The quality and demand for casks affect both cask and bottle values.

For instance, a rare whisky with few bottles made will likely grow in value as collectors want it.

Common Risks and Challenges

Whisky investing has risks you should know about. Here are some common ones:

-

The whisky cask investment market isn’t well-regulated, so fraud can happen.

-

It’s hard to check if casks or bottles are real without proof.

-

Prices might drop if the market becomes overvalued.

To stay safe, always do research and buy from trusted sellers or brokers.

How to Build a Profitable Whisky Portfolio

Setting Clear Investment Goals

Before starting whisky investing, decide what you want to achieve. Do you want quick profits or long-term growth? Maybe you hope to collect whiskies that grow in value over time. Knowing your goal helps you make better choices and stay focused.

Ask yourself these questions:

-

How much money can you invest?

-

When do you want to see returns?

-

Are you interested in rare bottles, casks, or funds?

For example, if you want long-term growth, casks might be best. A $10,000 cask could grow to $30,000 in 5–10 years, giving 30%–40% yearly returns. If you prefer faster profits, rare bottles may work better. A $1,000 bottle could sell for $3,000 in a few years.

By setting clear goals, you’ll have a plan to guide your whisky investments.

Diversifying Across Brands, Regions, and Types

Spreading your investments is important for success. Putting all your money into one whisky investment type is risky. Instead, invest in different brands, regions, and types to lower risks and increase profits.

Here are ways to diversify:

-

Brands: Buy from famous names like Macallan and new distilleries. Growing markets like India and Brazil offer exciting chances.

-

Regions: Try whiskies from Japan and India, not just Scotland. These are becoming more popular and profitable.

-

Types: Combine bottles, casks, and funds. Whisky funds and indexes give a mix of options and often perform better than regular markets.

For instance, Japanese whiskies are in high demand at auctions like Sotheby’s. Speyside casks have shown yearly growth of 8%–12%. By diversifying, you reduce risks and explore the global whisky market’s full potential.

Managing Risks Effectively

Whisky investment has risks, but smart planning can protect your money. Here’s how to manage risks:

-

Diversify: Invest in different brands, styles, and ages of whisky. This lowers the chance of big losses.

-

Learn the Market: Study whisky trends and buy from trusted sellers. Knowledge helps you avoid mistakes.

-

Store Properly: Keep whisky in a safe, cool place. Bad storage can ruin its value.

-

Avoid Fakes: Only buy from reliable dealers and check authenticity.

-

Balance Investments: Don’t put all your money into whisky. Mix it with other assets for safety.

For example, the cask market has fraud risks because it’s not well-regulated. Work with trusted brokers and get proper documents to avoid fake products.

Managing risks keeps your investment safe and helps you grow wealth through whisky.

Where to Buy Whisky for Investment

The whisky investment process may be tricky and finding the best and most credible place to buy whisky is key. It helps you build a strong and profitable portfolio. Whether you’re new or experienced, knowing where to shop matters. Let’s look at the top choices for whisky investment.

Buying Straight from Distilleries

Getting whisky directly from distilleries is very reliable. Many distilleries sell special releases, rare editions, and even casks. These often include certificates to prove they are real.

When choosing distilleries, think about these points:

Criteria:

Age Matters

- Older whiskies often grow in value. But age isn’t everything. Look at the distillery’s fame, rarity, and quality.

Scarcity and Rarity

- Small production runs make whiskies harder to find. Rare bottles are highly wanted by investors.

Brand Reputation

- Famous brands like Ardbeg and Balvenie are trusted. Their rare editions often increase in value.

Market Trends

- Check auction results to see what’s popular. Rare whiskies often sell for high prices at big auctions.

Tip: Sign up for mailing lists or memberships at your favorite distilleries. This gives you early access to special releases.

Working with Brokers and Platforms

Brokers and platforms make whisky investment easier. They connect you with rare bottles and cask of fine whisky. They also give expert advice, which is helpful for beginners or busy investors.

Here’s why brokers and platforms are useful:

-

Brokers share updates on whisky prices and trends.

-

They provide tools to track and manage your investments.

Alternative asset investments are becoming more popular. Many investors use alternative investment platform like Timeless Investments or Splint Invest to add whisky to their portfolios during uncertain times. These platforms also comply with local and international investing laws and regulations.

Note: Always check if brokers or platforms are trustworthy. Read reviews and check their history before investing.

Buying at Marketplaces or Auctions

Specialised marketplaces like Spiritory are the key-pillar to buy authenticated bottles from private sellers directly. Auction platforms can be also a good option for finding rare whiskies. Marketplaces and auction houses sell high-demand bottles and sometimes let you deal directly with sellers or collectors.

Here’s how auctioned whiskies have performed:

Whisky Name: Macallan Edition No 1

Initial Price: 90€

Auction Peak Price: 3000€

Current Value Range: 2000€

Potential Future Value: 4000€

Brands like Macallan and Ardbeg often lead auctions due to their rarity. Springbank is another favorite because it stays valuable over time.

“Who will buy it?” This shows why knowing market demand is important.

Private sales can also offer rare finds at good prices. But be careful to avoid fake products.

Tip: Use sites like Whisky Auctioneer to follow auction trends. This helps you spot good investment chances.

Storing and Protecting Your Whisky Investment

Keeping Whisky in Good Condition

Storing whisky the right way keeps it valuable. Bad storage can lower its quality and price. Follow these simple tips:

Best Practice

-

Stand bottles upright: Stops cork from breaking or getting damaged

-

Keep it cool and steady: Avoids damage from temperature changes

-

Block direct sunlight: Protects whisky from losing its quality

-

Control humidity levels: Keeps cork moist to stop leaks

Always keep bottles standing up to protect the cork. Store them in a cool place with no big temperature changes. Sunlight can harm the whisky, so keep it in the dark. Humidity is also important. If it’s too dry, the cork might shrink and cause leaks.

Tip: Use a wine fridge or special cabinet to store whisky safely. Older whisky maybe more sensitive which you should have an eye on.

Getting Insurance and Knowing the Rules

Whisky is valuable, so insurance is a smart idea. Here’s how to protect your collection:

-

Get insurance to cover theft, damage, or loss.

-

Save receipts and photos of your purchases for proof.

-

Make sure you have documents to show the whisky is real.

-

Buy only from trusted sellers to avoid fake products.

-

Learn the rules about owning rare bottles. Proper papers are key.

Insurance helps protect your whisky, but it works best if you have all the right records. Always keep proof of what you own and its value.

Note: Some insurance companies focus on luxury items like whisky. Look for these options.

Keeping Track of Whisky Records

Good records prove your whisky investment is real and valuable. Without them, selling it later could be hard and the long-term performance may not as expected.

Checking the cork, wax, and bottling style helps confirm authenticity. For example, proving a whisky was made in 1833 needs research and science. Experts check old records and test the whisky to confirm it’s real.

Write down details about every bottle or cask you own. Include when and where you bought it, who sold it, and any certificates. These records help you get better prices if you sell.

Tip: Use apps or digital tools to organize your whisky records. This keeps everything safe and easy to find.

Selling Whisky for Maximum Profit

Timing the Market Effectively

Selling whisky at the right time is very important. When you sell can greatly affect your profit. Whisky prices change based on demand, seasons, and auction schedules. For example, holidays are great for selling as buyers look for gifts. Auctions during peak times attract serious collectors. Watch market trends to decide the best time to sell. This helps you earn more money.

Exploring Sales Channels

There are many ways to sell your whisky investment. Each method has its own benefits. The whisky market offers options for both businesses and regular buyers. This variety helps you find more buyers and adjust to their needs.

Here are some common ways to sell:

-

Auctions: Perfect for rare or expensive bottles. Big auctions like Sotheby’s attract top bidders.

-

Private Sales: Great for direct deals with collectors. These often bring higher profits.

-

Online Platforms: Sites like Spiritory connect you with buyers worldwide.

-

Cask Broker: Can not only help you buy a cask of whisky but also sell a cask of whisky.

Using different methods increases your chances of finding the best buyer.

Negotiating and Closing Deals

Good negotiation skills can help you earn more. To get the best price, know your whisky’s value and use your connections. Here are some tips:

-

Timing: Sell when the whisky is most valuable. Older casks are worth more but lose some liquid over time.

-

Accurate Valuation: Check the whisky’s age, rarity, and brand reputation to set a fair price.

-

Industry Connections: Build relationships with brokers and collectors. They can offer better deals.

Be confident and patient when negotiating. Point out what makes your whisky special to justify your price. Having proof of authenticity, like certificates, can also help.

Tip: Keep all records and documents ready. Buyers pay more when they trust the whisky is real.

By following these steps, you’ll be able to sell your whisky for the best profit.

Making money from whisky investment needs work, but it pays off. You should learn, spread out your investments, and plan smartly. Here’s why these steps help:

-

Whisky companies made 57% more money since 2020. This shows how spreading investments works.

-

Smart spending of £15m improved whisky quality and new ideas.

-

Selling in places like Southeast Asia and the USA shows how trying new markets helps.

-

Saving costs and creating new products show why planning matters.

Start small, keep learning, and act wisely. Whisky’s rising value means you’re not just buying a drink—you’re growing your money. This whisky investment guide just suppose to help you getting into one of the most interesting alternative investment opportunities, but with everything you spend money on - be curious and make your own research.

FAQ

How can I start investing in whisky?

Begin with rare bottles and sought after whiskies from well-known distilleries. Look for limited editions or special releases. These are simple to store and easy to sell later. Study market trends and focus on trusted brands like Macallan or Yamazaki.

Tip: Join whisky groups online to learn from experienced investors.

How can I tell if a whisky is real?

Look for certificates, original packaging, and proper paperwork. Check for tampering signs, like broken seals or torn labels. Buying from trusted sellers or distilleries lowers the chance of getting fakes.

Note: Always check the history of rare or vintage whiskies before buying.

Can I invest in whisky without owning bottles or casks?

Yes, you can! Try whisky funds or indexes. These let you invest in the whisky market without needing to store anything. It’s a simple option for beginners or those with little space.

How long should I keep my whisky investment?

The time varies, but holding for 5–10 years often gives better returns. Rare bottles and casks usually gain value as they age. Watch market trends and sell when demand is high for your whisky.

Is whisky as an investment risky?

All investments have risks, and whisky is no different. Fraud, price changes, and bad storage can hurt value. Spread your investments and work with trusted brokers to stay safe.

Tip: Always research carefully and avoid deals that seem too good to be true.

About the author

Natalia Alejandrez Muñiz

I'm a whisky enthusiast and a writer in the making. I enjoy exploring new flavors, learning about the history behind each bottle, and sharing what I discover along the way. This blog is my space to grow, connect, and raise a glass with others who love whisky as much as I do.

To the author