29.09.2025

Will Whisky Investment Make a Comeback in 2026

Will Whisky Investment Make a Comeback in 2026

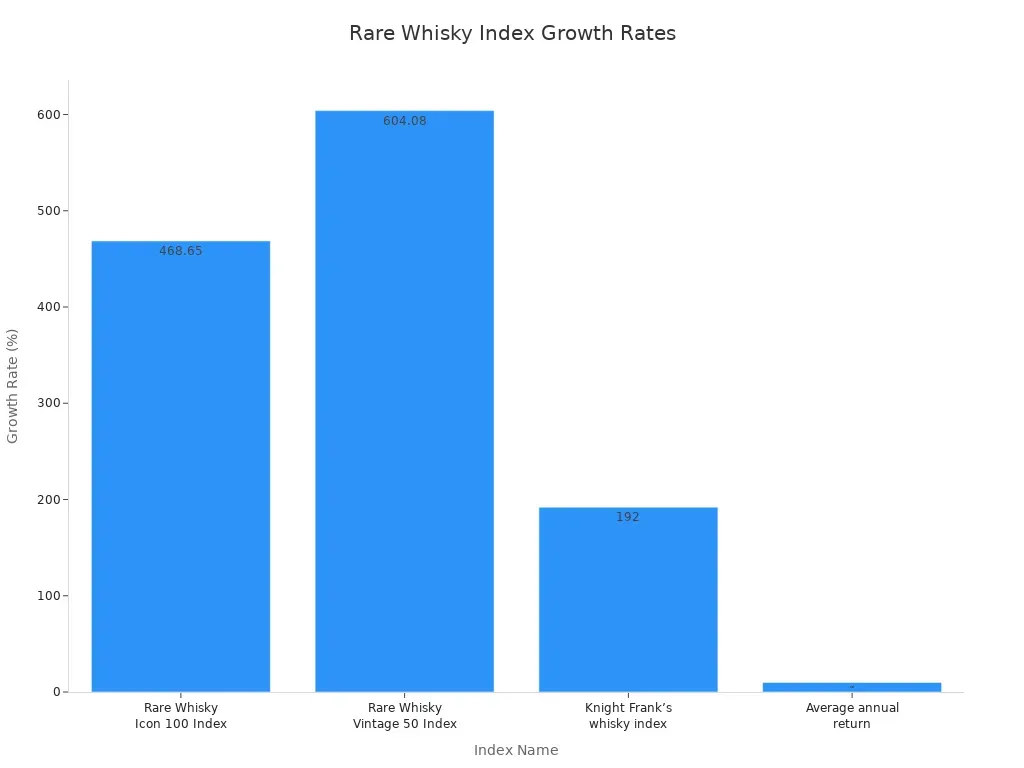

You might wonder if whisky investment will make a comeback in 2026. Recent data shows whisky outperformed the S&P 500 by 68% over five years, even during financial crises. The Rare Whisky Index soared 478%, far surpassing other alternative assets.

If you seek a resilient investment, whisky offers consistent appreciation and lower volatility. As you weigh risks and opportunities, ask yourself: Will there be a Whisky Investment Rebound in 2025?

Key Takeaways

-

Whisky has outperformed traditional investments, showing a 68% increase over five years, making it a resilient option for investors.

-

Focus on premium and rare whiskies, as they are gaining popularity among younger buyers and can offer strong returns.

-

Stay informed about market trends and brand reputations to avoid sudden losses in whisky investments.

-

Diversify your whisky portfolio by including different distilleries and age statements to reduce risk and enhance stability.

-

Be cautious of counterfeit bottles; always buy from reputable sources and verify authenticity to protect your investment.

State of the Whiskey Market

Recent Trends

You see many changes shaping the state of the whiskey market. The whisky investment market has shifted as premiumization takes center stage. Consumers now look for unique and artisanal brands, and you notice a growing demand for craft and single malt whiskey. Distilleries use new technology to improve distillation and aging. Internet marketing and direct-to-consumer platforms help brands reach you directly. Regulations now make cross-border trade easier, so you have more choices.

The supply glut since 2022 has changed how you view whisky investment. Too many new releases led to consumer fatigue. You now prefer established brands over overpriced newcomers. The Scotch Whisky Association reported an 18% drop in export value in the first half of 2024 compared to 2023. Whisky export volume fell by 10%. The secondary market for high-priced whiskey cooled as economic caution and market saturation set in.

-

The super-premium segment of whisky, priced above $30.50, grew 6% in 2024. You see more limited-edition releases and cask finishes, especially popular with younger buyers.

-

Standard and below price tiers dropped 4% in volume, showing how economic pressures affect the whisky market.

Market Performance

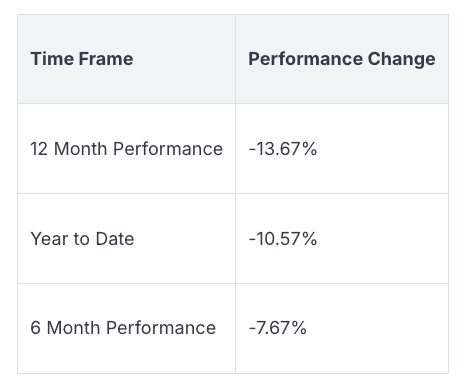

You can use the whisky investment index to track the whisky investment market. The index shows how the asset performed over the past year:

Over the past year, valuation multiples for spirits stocks compressed, with most trading between 14x and 23x EV/EBIT. This shift means investors like you feel cautious about whisky investment. Macroeconomic pressures have hurt whisky stocks. You may wonder what’s next for the whiskey market. The whisky investment index helps you see the current state of the whiskey market and decide what’s next for the whiskey market.

Will There Be a Whisky Investment Rebound in 2025

Key Drivers

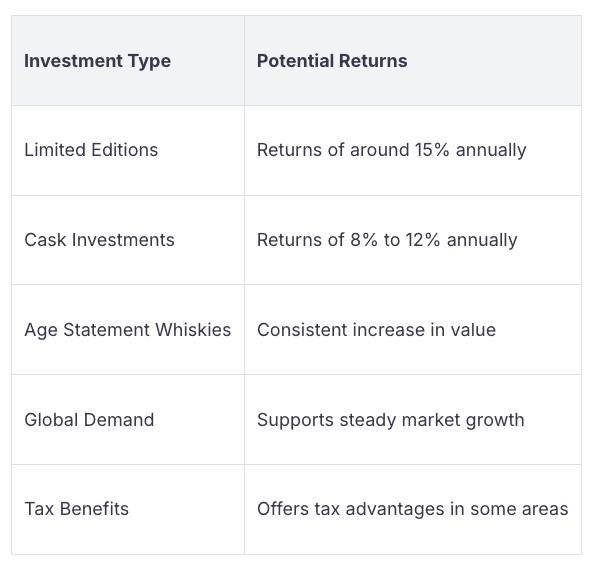

You may ask, will there be a whisky investment rebound in 2025? Several factors could drive this change. The whiskey industry continues to attract attention because of sustained consumer demand for premium and luxury spirits. You see more brands using e-commerce and digital retail channels, making it easier for you to buy whiskey online. Producers innovate with unique aging and flavor profiles, which appeal to new consumer groups. Sustainability and ethical consumption trends shape your choices. Demographic shifts bring younger buyers into the market, and strong brand loyalty supports impressive returns.

Global demand for whiskey remains strong, especially for rare and premium bottles. You notice that younger buyers now make up most of the market, with 75% under 50 and 43% under 40. Producers use bold marketing strategies and premiumization to attract these buyers. The craft cocktail movement and lifestyle branding also help whiskey stand out as an asset with impressive returns.

Barriers to Recovery

You still wonder, will there be a whisky investment rebound in 2025? The whiskey market faces several barriers. Trade tensions and supply chain issues create uncertainty. Tariffs and geopolitical disputes often lead to higher prices and reduced access, especially for U.S. distilleries. The Russia-Ukraine conflict has halted exports to Russia, cutting off a growing market. Rising living costs and high interest rates reduce consumer spending on whiskey, which affects whisky investment returns.

Distillery bankruptcies show the industry's fragility. Recent bankruptcies in Kentucky highlight how inflation and shifting demographics can disrupt the market. Overproduction also remains a risk, just as it did in the 1980s. You see declining exports and energy crises adding to the challenges.

Despite these obstacles, auction results suggest renewed buyer confidence. At Whisky Auctioneer, 15 out of 20 top lots sold, and rare bottles like Laphroaig 1967 13YO Cadenhead reached £20,000. The Macallan Folio 1 sold for £8,200, up from a 12-month average of £6,500. Many experts believe the collectable whisky market has bottomed out and is now rebounding. Producers like Pappy Van Winkle increase production to meet global demand for premium aged bourbons.

Rare Bottles

Impact of Interest Rates on Rare Bottle Prices

You may notice that rare whisky investments often react differently to economic changes than other assets. When global interest rates fall, you usually see more people spending on luxury items like premium whisky casks and rare bottles. This trend can boost price appreciation for rare whiskey. However, the relationship between interest rates and rare whisky prices is not always simple. While fine wine prices often drop when rates rise, rare whisky prices depend more on demand from collectors and new buyers. Demographic shifts and global expansion play a big role in shaping the market for rare whisky investments.

Case Study – Spirits Invest Karuizawa Whisky Index

The Spirits Invest Karuizawa Whisky Index gives you a clear example of how rare bottles can perform. From 2009 to 2017, as interest rates dropped, Karuizawa prices soared by ten times. During the COVID-19 period, when rates were low, Karuizawa bottles saw a price increase of 60%. This growth continued until late 2022, when prices reached an all-time high.

-

Karuizawa bottles gained 60% in value during the COVID-19 low-rate era.

-

Prices peaked in late 2022, showing strong demand for premium whisky casks.

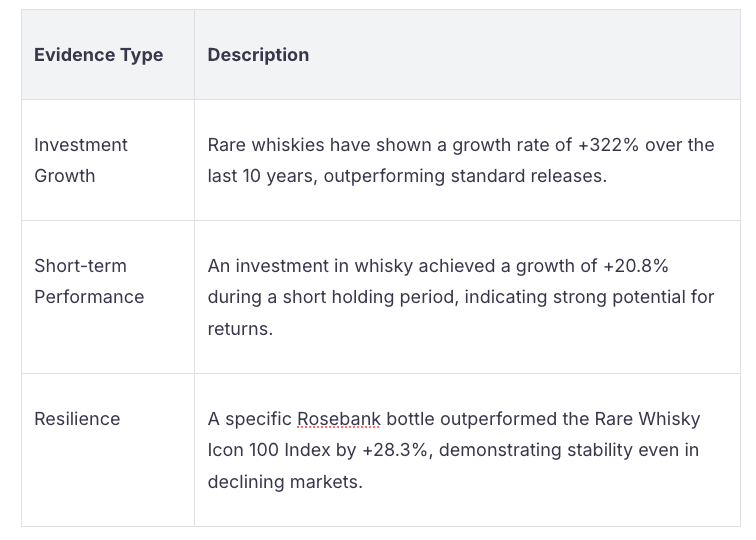

You can see that rare whisky investments often outperform standard releases. The table below shows how rare whiskey bottles compare to regular ones:

Outlook for 2025 and Beyond

You may wonder what the future holds for whisky cask investment and rare bottles. Experts predict strong growth for rare whisky investments in the next two years. As global interest rates fall, you can expect more demand for premium whisky casks and rare whiskey bottles. The market is showing early signs of recovery, with fewer unsold lots at auctions and more selective buying.

The table below highlights expert forecasts for rare whisky bottle prices:

The price of the 1961 Bowmore 50 Year Old Single Malt Scotch Whisky rose from $78,470 in May 2024 to $100,742 in May 2025, a 28.38% increase. The 1926 Macallan with the Valerio Adami label sold for about $2.7 million at Sotheby’s in November 2023.

If you focus on whisky cask investments and premium whisky casks, you may see strong returns as the market rebounds. Rare whisky investments remain a powerful asset for those seeking long-term price appreciation.

Risks in Whisky Investment

Market Volatility

You face several risks when you enter the whiskey market. The value of whiskey can change quickly because of demand, brand reputation, and global economic shifts. You might see prices rise during periods of high interest, but sudden drops can happen if the market cools. Many investors experience price corrections when too many bottles flood the market or when consumer trends shift. The whisky industry often reacts to changes in global trade, making your investment less predictable.

Tip: Track market trends and brand popularity before you buy. This helps you avoid sudden losses and keeps your asset safer.

You also need to think about storage costs and cask integrity. If you do not store whiskey properly, you risk losing value. Costs can add up over time, especially if you invest in casks. The lack of regulation in whisky investment means you must rely on your own research and trusted sources.

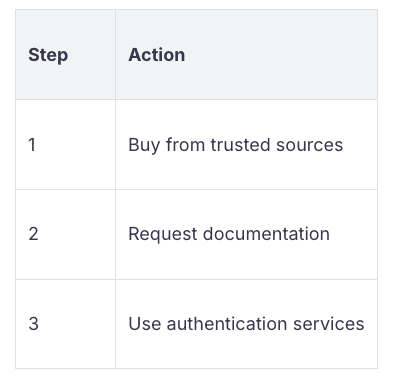

Fraud and Liquidity

You must watch out for counterfeit whiskey. Rare bottles in the secondary market can have counterfeit rates as high as 30-40%. This problem creates financial risks for you, especially if you buy older or valuable bottles. Authenticating rare whiskey often requires advanced techniques, so you should work with experts or reputable dealers.

Liquidity is another challenge in whisky investment. You may find it hard to sell your whiskey quickly. Many investors struggle to find buyers when they want to exit. You need a clear exit strategy because whiskey is a long-term asset. The maturation period can affect when you can sell, and holding onto casks too long may mean missing peak value.

-

Common exit challenges:

-

Holding casks past their prime.

-

Difficulty finding buyers.

-

Focusing only on short-term gains.

-

You should understand the differences between selling whiskey at auction, bottling for resale, or selling to independent bottlers. Many companies promise easy buybacks, but established distilleries rarely purchase casks from investors. You must plan your exit carefully to protect your investment.

Practical Steps for Investors

Dos and Don’ts

You can improve your chances of success in whisky investment in the UK by following some key dos and don’ts. Start by doing your homework. Learn about the whiskey market and keep up with trends. Buy only from reputable retailers and auction houses. Scarcity often drives value, so consider rare or limited releases. Always store whiskey in proper conditions to protect your asset.

Tip: Invest in casks rather than bottles for better risk management and potential value appreciation. Make sure your casks are registered and managed in a bonded warehouse. This provides strict oversight and quality control. Use insurance to protect against disasters and theft.

Here are some important dos and don’ts for whisky investment in the UK:

-

Do:

-

Build a diverse portfolio with different distilleries, age statements, wood types, regions, and countries.

-

Understand your exit options, such as selling to independent bottlers or at auction.

-

Check naming rights for each cask, as this affects value.

-

Keep detailed records of all transactions and provenance.

-

Engage with experts and review your portfolio regularly.

-

-

Don’t:

-

Avoid offers that seem too good to be true or promise quick returns.

-

Never buy from companies without the correct licenses for whisky storage.

-

Do not purchase multiple casks from the same year and distillery.

-

Never invest more than you can afford to lose.

-

Do not ignore market trends or make impulsive decisions.

-

Building a Portfolio

You can build a strong whisky investment in the UK portfolio by focusing on diversification and due diligence. Diversification helps protect your investment from market swings. Consider adding whiskey from different regions, distilleries, and age statements. This approach can make your portfolio more resilient.

During economic uncertainty, whisky values may remain stable. Well-selected bottles can even rise in value when stock markets fall. To make smart choices, follow these due diligence steps:

-

Verify authenticity and provenance.

-

Check recent auction results for similar bottles.

-

Inspect the condition of each bottle or cask.

-

Research the distillery and expression history.

-

Consider storage and insurance costs.

-

Plan your exit strategy.

Whisky investment opportunities in the UK reward careful planning. By following these steps, you can reduce risk and take advantage of the growing whiskey market.

You see signs that whiskey investment could make a comeback in 2026. Awards and global demand often boost the whiskey market, especially for rare bottles.

Awards can dramatically alter a whiskey's market dynamics, often leading to a surge in demand. When a whiskey wins an award, it gains an instant boost in visibility and consumer interest, which can lead to increased sales and a rise in market demand.

If you want to enter the whiskey market, consider these steps:

-

Conduct thorough research on the whiskey market and products.

-

Recognize whiskey is an illiquid investment.

-

Be aware of risks like fraud and physical loss.

You should weigh both risks and opportunities before making your decision.

FAQ

What makes whisky a good investment compared to other assets?

You see whisky offer low correlation with stocks and bonds. Rare bottles often appreciate steadily. You can benefit from global demand and limited supply. Whisky also provides portfolio diversification.

Tip: Rare whisky bottles can outperform traditional investments during market downturns.

How do you avoid buying counterfeit whisky?

You should buy from reputable auction houses or licensed retailers. Always check provenance and request authentication certificates. You can use expert services for bottle verification.

What risks should you consider before investing in whisky?

You face risks like market volatility, fraud, and liquidity issues. You may struggle to sell quickly. Storage and insurance costs can reduce your returns. You must research before you invest.

How long should you hold whisky for the best returns?

You usually see the best returns after holding whisky for at least five years. Rare bottles and casks often appreciate more over time. You should monitor market trends and auction results.

Note: Patience often leads to higher profits in whisky investment.

-

About the author

Natalia Alejandrez Muñiz

I'm a whisky enthusiast and a writer in the making. I enjoy exploring new flavors, learning about the history behind each bottle, and sharing what I discover along the way. This blog is my space to grow, connect, and raise a glass with others who love whisky as much as I do.

To the author