31.10.2025

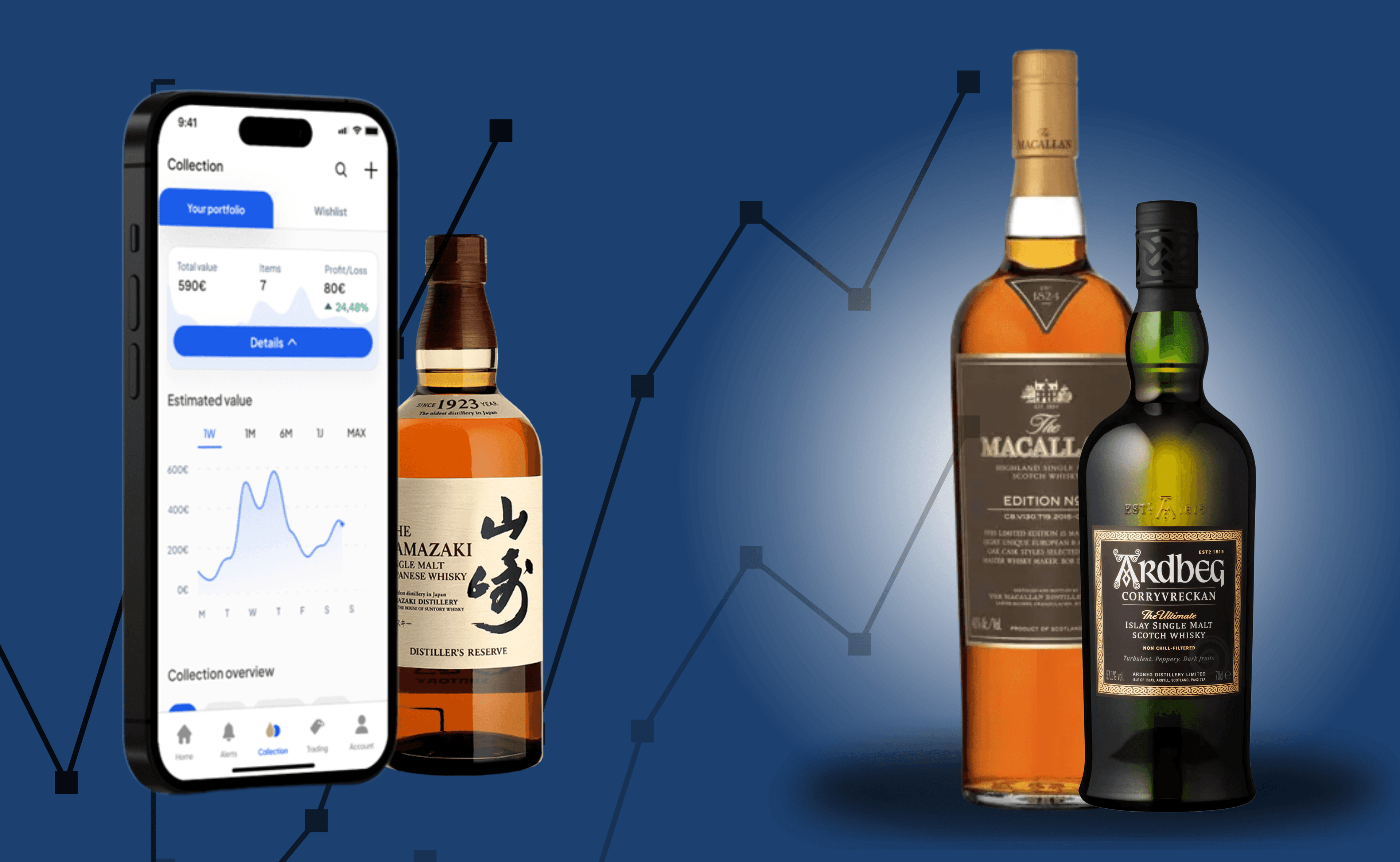

Build a Resilient Whisky Collection as the Market Stabilises

Build a Resilient Whisky Collection as the Market Stabilises

Market Stabilization and Its Implications for Collectors

The whisky secondary market experienced significant volatility over recent years, with sharp declines in both transaction volumes and values. However, data from Noble & Co’s Q3 2025 Whisky Intelligence Report indicates a shift towards stabilisation. Although total transaction volumes fell by 26% year-on-year and overall values declined by 40%, the market is settling into a “new rhythm” marked by fewer unsold lots and stabilising price floors. This environment encourages a more disciplined approach among buyers, who are increasingly focusing on building collections with lasting value rather than pursuing speculative gains.

This trend of stabilisation is particularly important for collectors aiming to construct resilient whisky collections. It signals an opportunity to prioritise diversification, provenance, and liquidity planning, rather than chasing fleeting market hype. As the secondary market matures, collectors can benefit from more rational valuations, making it an ideal time to build durable holdings that balance enjoyment with capital preservation.

Principles of Building a Resilient Whisky Collection

Constructing a resilient whisky collection requires adherence to five interconnected principles: diversification across regions and styles, provenance documentation, proper storage and insurance, well-planned exit strategies, and acceptance of longer holding periods. Together, these form the foundation for collections that withstand market cycles while delivering both pleasure and investment potential.

Diversification Across Regions and Styles

Diversification is essential to mitigate risks associated with market fluctuations. A robust collection balances Scotch whisky from multiple regions—Highlands, Speyside, Islay—with international expressions such as Japanese, American, and emerging markets like Taiwan or Sweden. For example, while Scottish single malts remain core holdings, Japanese whiskies have gained traction among collectors in Asia and the Middle East due to steady price appreciation.

Cask type also plays a critical role: ex-bourbon casks provide a baseline flavour profile and availability, whereas ex-sherry casks command premiums for their rarity and complex flavour contributions. An effective allocation might include approximately 50% Scotch across diverse regions, 20% Japanese and Irish whiskies, 20% American single malts—especially from the Pacific Northwest and California—and 10% experimental bottlings. This approach reduces concentration risk inherent in chasing any single brand or style.

Storage and Insurance Best Practices

Proper storage and insurance are vital to maintaining a whisky collection’s condition and value over time. Environmental factors such as temperature stability, humidity control, bottle orientation, and protection from light significantly influence whisky quality and label preservation.

Optimal Storage Conditions

Whisky bottles should be stored upright to prevent cork desiccation that leads to oxidation. Temperature stability matters more than absolute temperature; fluctuations accelerate evaporation and degrade corks. Bonded warehouses typically maintain stable conditions between 10°C and 15°C with humidity levels between 50% and 70%, ideal for preserving both liquid integrity and label quality.

Avoid direct sunlight or proximity to heat sources as these accelerate unwanted ageing effects that diminish flavour complexity. A cool, dark cupboard or dedicated wine fridge outperforms decorative displays by protecting bottles from environmental stressors that erode value over time.

Insurance Options for Collectors

Insurance coverage is crucial for safeguarding against loss or damage. Collectors can choose between blanket coverage—aggregating risk under a single per-item limit—and itemised scheduling where high-value bottles are insured individually based on updated valuations.

For collections with bottles exceeding £5,000 in value, itemised coverage is generally more cost-effective despite requiring periodic revaluation every two to three years. Annual insurance costs typically range from 0.5% to 1.5% of the collection’s total value when combined with storage expenses. These costs should be factored into the expected returns on investment and may justify longer holding periods focused on bottles with proven appreciation trajectories.

Understanding Exit Strategies for Liquidity

Planning exit strategies early is essential for maximising liquidity and capital preservation when selling whisky holdings. Whether cask owners or bottled whisky collectors, understanding sales routes helps optimise returns while managing timing risks.

Selling Bottles: Auction vs. Private Sales

Auctions offer transparent pricing driven by competitive bidding but can involve fees that reduce net proceeds. They are ideal during periods of strong market sentiment when buyer attendance is high—typically spring and autumn seasons—maximising final hammer prices for provenance-rich bottles.

Private sales provide discretion and potentially faster transactions but require trusted networks to ensure fair pricing. Specialist retailers often facilitate private deals by connecting sellers with serious collectors or investors willing to pay premiums for documented provenance.

Timing Your Sales

Market timing significantly influences sale outcomes. Data indicates that Q2 2025 saw higher transaction volumes than Q1 as buyer confidence returned amid stabilisation trends. Seasonal windows coincide with major auctions attracting international bidders.

Prudent collectors avoid reactive selling driven by financial need; instead they plan portfolio rotations every seven to ten years to harvest appreciation gains and reinvest capital into emerging opportunities or diversified holdings.

Risk Management for Collectors

Mitigating risks associated with whisky collecting safeguards both enjoyment and investment potential amid fluctuating markets.

Mitigating Market Volatility

Diversification remains the primary strategy against volatility—balancing trophy-tier bottles with mid-tier expressions that sustain liquidity in the £100–£500 range. Distilleries like Springbank demonstrate how steady trading volumes complement high-value brands such as Macallan in building resilient portfolios.

Selective purchasing focused on authentic scarcity—such as independent bottlings at cask strength without chill filtration—reflects market discipline replacing hype-driven speculation.

Authentication Risks

Authentication is critical given increasing counterfeit sophistication globally. Provenance documentation combined with modern verification technologies protects collectors’ holdings from fraud-related losses.

Platforms employing blockchain tracking or spectrometric liquid analysis add layers of security that enhance resale credibility over time. Maintaining meticulous records transforms collections into trusted assets attractive to discerning buyers on marketplaces like Spiritory.

Outlook for Whisky Collectors

The stabilisation evident in late 2025 presents an encouraging outlook for collectors seeking long-term value in their whisky portfolios. The market’s recalibration away from speculative bubbles towards selective acquisition emphasises resilience through diversification, provenance integrity, proper storage, insurance coverage, and thoughtful exit planning.

This environment invites collectors to build balanced collections combining classic Scotch regions with international styles while embracing mid-tier bottles alongside ultra-rare releases. As confidence returns steadily among buyers worldwide—including those attracted by rising demand for Japanese whiskies—the opportunity arises to cultivate holdings that provide genuine pleasure alongside sustainable capital preservation.

Collect responsibly: Enjoy your whiskies moderately while appreciating their craftsmanship and heritage over time.

FAQs

How important is diversification when building a whisky collection?

Diversification across regions like Scotland’s Highlands and Speyside alongside Japanese and American whiskies helps reduce risk associated with fluctuating demand or tariffs affecting specific markets. A balanced mix of cask types and age statements further enhances resilience against volatility. Spiritory offers access to diverse selections supporting well-rounded collections tailored to your goals.

What steps can I take to verify the authenticity of my whisky purchases?

Maintaining provenance documentation such as auction certificates or retailer invoices is essential. Advanced verification methods like blockchain-backed NFTs or spectrometric analysis provide additional security layers against counterfeiting. Using trusted platforms like Spiritory ensures listings come with verified provenance records enhancing your collection’s credibility.

What are the best storage conditions for preserving whisky quality?

Store bottles upright in stable environments between 10°C–15°C with humidity around 50%–70%. Avoid direct sunlight or heat sources that accelerate deterioration of corks and labels. Dedicated wine fridges or bonded warehouses offer optimal conditions protecting both liquid integrity and presentation value over time.

When is the best time to sell whisky bottles for maximum return?

Sales typically perform best during spring and autumn auctions when international buyer attendance peaks. However, timing depends on market sentiment; prudent collectors plan exits as part of portfolio rotations every seven to ten years rather than reacting impulsively. Monitoring trends via reports like Noble & Co’s Whisky Intelligence can inform optimal selling windows.

How can I insure my whisky collection effectively?

Choose between blanket insurance covering all items under one policy or itemised scheduling declaring high-value bottles individually for tailored coverage. For collections containing bottles valued above £5,000 each, itemised insurance is usually more cost-effective despite requiring periodic revaluations every two to three years. Factor insurance costs into your overall investment strategy for realistic return expectations.

Explore this moment of market stabilisation by building your resilient whisky collection thoughtfully — find verified listings on Spiritory today!

Please drink in moderation; legal drinking age applies.

About the author

Majda Hübner

My journey with whisky truly began when I joined Spiritory in 2024. What started as a job quickly grew into a deep appreciation for the stories behind each bottle. From elegant Highland single malts to bold American rye, every expression has its own unique charm. Through the blog, I share discoveries, insights, and favorites hoping to inspire both newcomers and fellow enthusiasts alike. If you love whisky or are just starting to explore it, welcome - you’re in good blog.